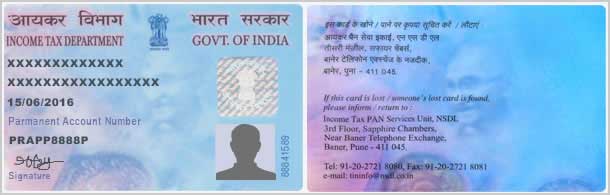

Tightening the noose around tax evaders, the Indian Govt has asked banks to obtain PAN (permanent account number) or Form-60 if PAN is not available, from all bank account holders by Feb 28, 2017.

“Income-tax Rules have been revised to provide that bank shall obtain and link PAN or Form No. 60 (where PAN is not available) in all present bank accounts (other than BSBDA) by February 28, 2017, if not already done,” a notification by the CBDT (Central Board of Direct Taxes) stated today.

The persons who are having bank accounts but have not submitted PAN or Form No 60 are advised to submit the PAN or Form No 60 to the bank by February 28, 2017, the notification stated.

However, this rule will not apply to BSBDA (Basic Savings Bank Deposit Accounts), which are zero balance savings accounts, including Jandhan accounts.

The BSBDA were launched to take care of simple banking needs of people, which come with free ATM card, monthly statement and cheque book.

Last month, RBI had mandated that no withdrawal shall be allowed from the accounts having substantial credit balance/deposits if PAN or Form No.60 is not provided in respect of such accounts.

It further said that the banks and post offices had also been mandated to submit information in respect of cash deposits from April 1, 2016 to November 8, 2016 in accounts where the cash deposits during the period November 9, 2016 to December 30, 2016 exceeds the specified limits.

It has also been provided under the new rules that person who is required to obtain PAN or Form No.60 shall record the PAN/Form.No.60 in all the documents and quote the same in all the reports submitted to the Income-tax Department.

Share This Article With Friends

To get news on WhatsApp free, just send ‘Start’ to 9729997710 via WhatsApp